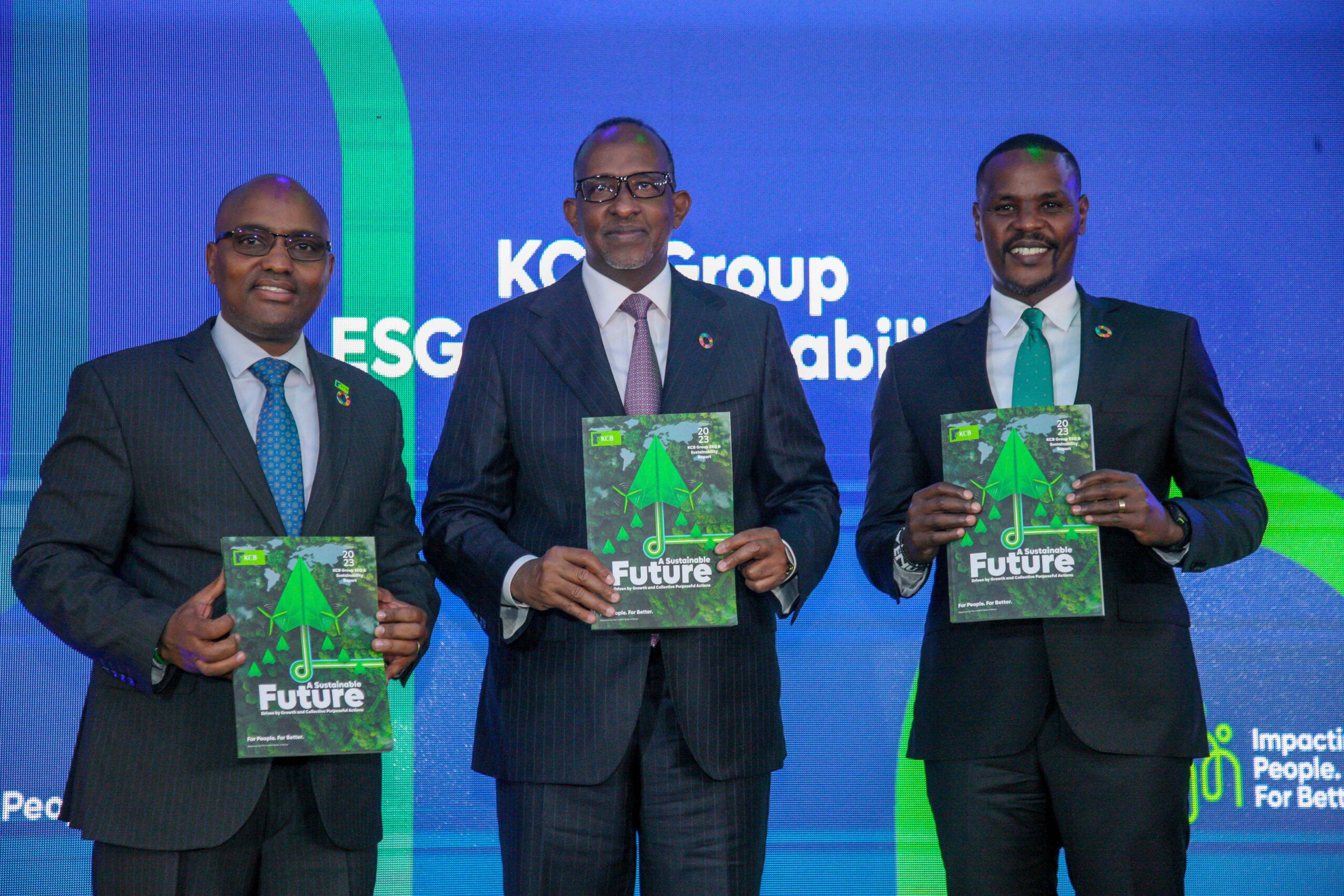

KCB Group CEO Paul Russo(L), Cabinet Secretary, Environment, Climate Change and Forestry Hon. Aden Duale(C)and Principal Secretary, Environment & Climate Dr. Eng. Festus Ng’eno(R)

In a significant stride towards sustainable finance, KCB Group has announced it screened a remarkable KShs. 615 billion in loans for environmental and social risks throughout 2023.

This ambitious move underscores the bank’s dedication to supporting projects that positively impact the environment.

As of the end of last year, this amount represented half of KCB’s total loan portfolio, highlighting its commitment to integrating sustainability into its financial practices.

The bank’s dedication to green finance is further exemplified by its approval of KShs. 21.4 billion in green loans, which accounts for 15.5 percent of its entire loan portfolio for 2023. These green loans have been directed towards critical areas such as e-mobility, climate change adaptation and mitigation, energy efficiency, and renewable energy projects. This substantial allocation reflects KCB’s strategic focus on community-centric initiatives designed to generate sustainable value for all stakeholders.

The bank’s sustainability progress is documented in its newly launched 2023 Environmental, Social & Governance (ESG) and Sustainability Report. Notably, KCB has achieved a pioneering milestone as the first financial institution in Africa to have its ESG report assured by external auditors. This move marks a new era of transparency and reliability in ESG reporting across the continent.

KCB Group CEO Paul Russo(L), Cabinet Secretary, Environment, Climate Change and Forestry Hon. Aden Duale(C)and Principal Secretary, Environment & Climate Dr. Eng. Festus Ng’eno(R) unveil the 2023 KCB Group ESG & Sustainability Report. This was during the launch of the Sustainability Report held at the Heart of Kencom Nairobi.

KCB Group CEO Paul Russo(L), Cabinet Secretary, Environment, Climate Change and Forestry Hon. Aden Duale(C)and Principal Secretary, Environment & Climate Dr. Eng. Festus Ng’eno(R) unveil the 2023 KCB Group ESG & Sustainability Report. This was during the launch of the Sustainability Report held at the Heart of Kencom Nairobi.

Paul Russo, KCB Group CEO, emphasized the bank’s commitment to environmental stewardship and transparency. “We are intensifying our focus on sustainability and environmental responsibility. The release of the first assured report in Africa is a testament to our commitment and sets a new benchmark in ESG reporting. Our key performance indicators and metrics accurately reflect the bank’s performance, thereby enhancing transparency and accountability. By aligning our business practices with sustainability principles, we aim to drive long-term value creation, bolster our reputation, and mitigate environmental and social risks.”

KCB’s commitment extends to addressing a broad spectrum of global challenges by aligning with 14 Sustainable Development Goals (SDGs). A key initiative includes the bank’s calculation of its financed emissions for 2023, specifically focusing on Scope 3 emissions from its primary carbon-intensive sectors. This bold step underscores the bank’s proactive stance in tackling the climate crisis.

The bank’s dedication to reducing its carbon footprint is further demonstrated by its ambitious reforestation efforts. In 2023, KCB committed to planting over 300,000 trees in Kenya, with a goal of reaching 1.2 million trees by the end of 2024. Additionally, the bank achieved an 11.14 percent reduction in carbon footprint intensity per staff member and increased the installation of LED lighting by 50 percent, optimizing resource usage and reducing energy consumption.

In his address during the report launch, Hon. Aden Duale, Cabinet Secretary in the Ministry of Environment, Climate Change and Forestry, lauded KCB’s efforts. “As we tackle the urgent challenges of climate change, it is imperative that every entity plays its part. KCB’s investments in green finance, reforestation, and sustainable development illustrate that financial institutions can lead in this endeavor. The government is committed to supporting such initiatives that align with our national objectives of environmental conservation, climate resilience, and inclusive growth.”

Beyond environmental efforts, KCB’s socio-economic initiatives are making a substantial impact. In 2023, the bank supported 2,877 youth through its 2jiajiri entrepreneurship program, generating 13,352 direct jobs. Additionally, KCB extended KShs. 115 billion in loans to women-owned businesses, advancing gender equality and empowering female entrepreneurs. The bank also allocated KShs. 100 billion in loans to Micro, Small, and Medium Enterprises (MSMEs), crucial drivers of economic development in the region.

Looking ahead, KCB Group is setting a target to allocate 25 percent of its total loan portfolio to sustainable initiatives by 2025. This ambitious goal underscores the bank’s commitment to leading the charge in climate action and sustainable development, demonstrating that financial institutions can effectively address global challenges while fostering economic growth and social equity.